For many owners, when your bar or restaurant opens, it’s the culmination of a long, elaborate process. You’ve likely spent countless hours poring over every detail of that process, slowly transforming your dream into a reality. One of the most important details is pricing your beer at a level that makes sense for your business. You can’t charge so much that no one will come in and patronize your bar, but you also can’t give things away unless you have a magic pile of money that replenishes itself. That’s where this handy keg yield chart and calculator come in.

Using this chart as a reference, you can quickly and easily understand how much money each ½ keg you have represents for your bottom line at your preferred price point. Basically, this chart is a shortcut to helping you make money. A standard ½ barrel keg holds roughly 1,984 ounces of beer. Keep this number in mind when you’re setting prices per serving in your bar, and we promise, you’ll never lose money.

Quick Reference Keg Yield Chart

Scroll for more

| Price Per Serving | $3.50 | $3.75 | $4.00 | $4.25 | $4.50 | $5.00 | $6.00 | |

| 10 oz. 198 pours |

$693.00 | $742.50 | $792.00 | $841.50 | $891.00 | $990.00 | $1188.00 |  |

| 12 oz. 165 pours |

$577.50 | $618.75 | $660.00 | $701.25 | $742.50 | $825.00 | $990.00 |  |

| 14 oz. 141 pours |

$493.50 | $528.75 | $564.00 | $599.25 | $634.50 | $705.00 | $846.00 |  |

| 16 oz. 124 pours |

$434.00 | $465.00 | $496.00 | $527.00 | $558.00 | $620.00 | $744.00 |  |

| 20 oz. 99 pours |

$346.50 | $371.25 | $396.00 | $420.75 | $445.50 | $495.00 | $594.00 |  |

This chart tells you what the standard beer glass is for your preferred ounce serving of a given beer. So maybe you have a high ABV (alcohol by volume) beer that you only want to serve in 10 ounce glasses (like a British half pint) to help keep everyone from getting over-served. To understand how you should price that, simply consult the top row and see where you need to be to break even/pull ahead on the price of your keg. For example, you’ll note that at that top row (10 oz.) level the difference between a $3.50 and a $3.75 serving amounts to essentially $50 per keg. Maybe that’s enough, maybe it’s not. But at least you know. And once you have that information quickly at your fingertips, you can make informed decisions that help keep your business in a position to thrive and grow.

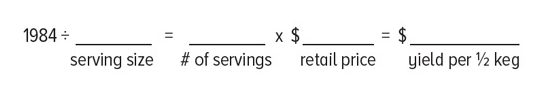

Keg Yield Equation

If you prefer to ignore the chart (maybe you’re marketing your bar as the home of the 11 ounce craft pour), the equation itself offers all the information you need to understand how much profit you’ll garner from a single ½ barrel keg. Simply start with those same 1,984 ounces then divide it by the number of ounces you’d like to have in a serving. From that number, you’ll derive the number of servings available to you in that keg, then just multiply that number by various proposed price points and you’ll see just how much money you can recoup for your keg. Once you subtract the cost of that keg (and any other allocated expenses that come directly from your bar program) from what you can charge for it, you’ll end up with a number that keeps you in the red or black.

Obviously, there are a number of factors that go into keeping your bar or restaurant solvent. But ensuring that your draft beer program is profitable is a great start towards keeping things afloat, and we promise that this chart/equation will help you do just that.

Leave a Comment